The Greatest Guide To Banking

Wiki Article

See This Report about Bank Statement

Table of ContentsThings about BankingGetting The Bank To WorkThe Single Strategy To Use For Bank StatementBanking Things To Know Before You Buy

You can likewise save your money and also make rate of interest on your investment. The cash saved in many checking account is government guaranteed by the Federal Deposit Insurance Coverage Corporation (FDIC), up to a restriction of $250,000 for individual depositors and $500,000 for collectively held deposits. Banks additionally give credit rating possibilities for people and firms.

Financial institutions make a revenue by billing even more interest to debtors than they pay on interest-bearing accounts. A financial institution's size is established by where it is situated and that it servesfrom little, community-based establishments to big business banks. According to the FDIC, there were simply over 4,200 FDIC-insured commercial financial institutions in the United States since 2021.

Convenience, rate of interest prices, and fees are some of the aspects that aid consumers choose their preferred financial institutions.

Not known Details About Bank Definition

banks came under intense analysis after the worldwide monetary crisis of 2008. The regulatory setting for financial institutions has because tightened substantially therefore. United state banks are regulated at a state or nationwide level. Depending on the structure, they might be controlled at both degrees. State financial institutions are controlled by a state's division of financial or department of financial establishments.

, for example, takes down payments and offers locally, which might use a more bank of america login individualized financial relationship. Select a convenient location if you are selecting a financial institution with a brick-and-mortar location.

Some Known Facts About Bank Reconciliation.

Some banks likewise use smart device apps, which can be helpful. Some big financial institutions are relocating to finish overdraft fees in 2022, so that could be a crucial factor to consider.Money & Growth, March 2012, Vol (bank statement). 49, No. 1 Institutions that match up savers and customers help guarantee that economic climates work smoothly YOU'VE got $1,000 you do not require for, claim, a year and also intend to earn income from the cash until after that. Or you intend to acquire a residence and also require to borrow $100,000 and pay it back over 30 years.

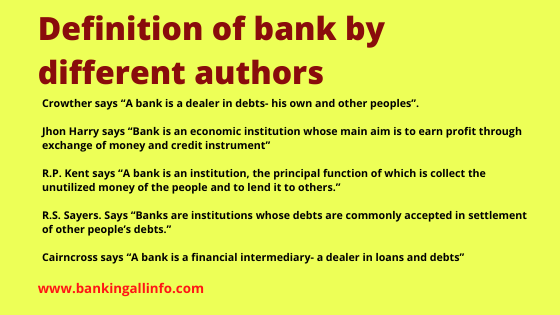

That's where financial institutions can be found in. Banks do numerous things, their key function is to take in fundscalled depositsfrom those with money, pool them, and also provide them to those who require funds. Financial institutions are intermediaries between depositors (that lend cash to the bank) and borrowers (to whom the financial institution offers money).

Down payments can be readily available on need (a checking account, for instance) or with some constraints (such as savings and time down payments). While at any provided minute some depositors need their cash, most do not.

All about Bank

The process entails maturation transformationconverting short-term obligations (down payments) to lasting possessions (car loans). Financial institutions pay depositors less than they obtain from debtors, and that distinction make up the mass of banks' revenue in many nations. Financial institutions can complement typical deposits as a source of financing by directly borrowing in the money and also capital markets.

Financial institutions keep those required books on deposit with reserve banks, such as the United State Federal Reserve, the Bank of Japan, as well as the European Reserve Bank. Financial institutions create money when they lend the remainder of the money depositors give them. This money can be used to acquire products and also services and can locate bank account requirements its means back into the banking system as a deposit in another bank, which then can lend a fraction of it.

The size of the multiplierthe quantity of cash developed from a first depositdepends on the quantity of cash financial institutions have to maintain on get (bank account). Banks also lend and reuse excess cash within the monetary system and create, disperse, as well as trade safeties. Banks have several methods of making cash besides taking the difference (or spread) between the rate of interest they pay on deposits as well as borrowed cash as well as the rate bankrate of interest they collect from borrowers or protections they hold.

Report this wiki page